By Bodo Kottwitz (BKay Tissue Advice) and Esko Uutela (Fastmarkets | RISI)

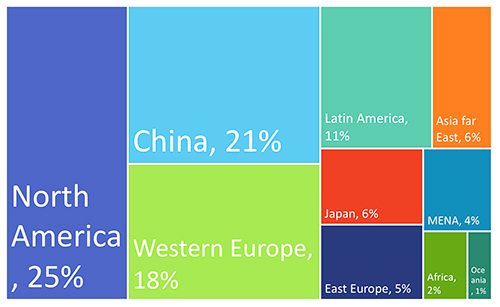

The worldwide tissue market is dynamic and adaptable. In recent years, China managed to surpass Western Europe in market size, making it the largest single country producer since 2015. Similarly, Far East Asia as well as Eastern Europe are soon set to overtake Japan in the global market of tissue consumption (Figure 1). Meanwhile, despite some countries facing economic hardships, the Middle East and North Africa (MENA) region is recording an overall growth in retail tissue due to an economic and social development helping raise hygiene awareness levels and provide consumers with access to disposable retail tissue products through modern grocery retailers. The MENA region is indeed experiencing one of the world’s strongest relative tissue consumption growth in the past 20 years. The following article outlines the details of this recent market trend and its future demand projections.

Geographical Scope

Defining the scope

Depending on the source used, the exact geographical boundaries of the MENA region differs. In the following analysis, the definition excludes Mauretania, Somalia, Sudan, and Western Sahara, with acknowledgement that they are interesting cases to be considered at some point. On the other hand, due to geographical and market connectiveness, we include Cyprus, Turkey, Armenia and Azerbaijan, which are important trading partners in the region. Case in point, Egypt exports tissue products to Cyprus, while Turkey is a major exporter to Iraq, Azerbaijan, Lebanon, Syria, Jordan, and recently Saudi Arabia and the United Arab Emirate (UAE), whereas Iran started sending some exports to Armenia and Azerbaijan.

Populations as industry drivers

The population of the MENA region was estimated at 513 million in 2016, about 100 million people more than in Western Europe, with a significant population growth reaching about seven million people per year, dwarfing Western Europe where population growth is typically negligible to very moderate growth at best. Interestingly, the less populated Western Europe consumes four times as much tissue than the MENA region. Thus, the growing population and the low tissue consumption rates in the MENA region provide ample opportunities for the tissue business to expand. The most interesting development prospects are arguably found in the three most populous countries of the region – Egypt, Iran and Turkey – which account for exactly half of the MENA population (Figure 2). Whereas other countries with smaller (though still significant) population bases such as Algeria, Iraq, Morocco and Saudi Arabia are attractive for companies to plan expansion there. However, a major point to consider when entering these potential markets is the country’s Gross Domestic Product (GDP) per Capita. An indicator that is often referred to as a comprehensive scorecard for showing the level of economic welfare between countries, however it can be considered somewhat misleading. When comparing MENA countries, the GDP reveals huge variation in the region. Oil producing countries are at the forefront of this comparison, led by the UAE, Kuwait and Saudi Arabia (Figure 3). Of course, oil revenues are linked to an uneven income distribution that does not represent well the actual purchasing power of an average citizen. Nevertheless, oil has helped the local economies in many ways.

.jpg) |

.jpg) |

|

Figure 2: Population in the MENA Region, 2016 |

Figure 3: GDP per capita in select main countries |

Recent market trends

Total tissue consumption in the MENA region has been steadily growing; from 1.615 million tonnes in 2016 to 1.742 Million tonnes in 2017, marking a 7.86% increase in a single year. The four largest consumers – Turkey, Saudi Arabia, Iran and Egypt account for 66% of the total regional consumption (Figure 4). Though Egypt and Iran, the countries with a third of the regional population, account for less than 20% of tissue consumption. Remarkably, smaller countries like UAE, Kuwait, and Lebanon which collectively make up 3.8% of total MENA population, consume about 10% of the region’s tissue utilization, likely due to higher standards of lifestyle and living. Indeed, the small country of Lebanon appears to have per-capita consumption rates at par with Saudi Arabia, despite having one fifth of its GDP per capita rate (Figure 5). Overall, there are major differences in per-capita consumption of tissue in the region. In fact, Cyprus has similar consumption levels as an average Western European country, followed by Kuwait, UAE and Bahrain with rather high figures as well (over 13.5 kg per capita in 2016). Noteworthy considering toilet paper is not the main product consumed in the aforementioned countries but rather facial tissues, a trend often attributed to religious traditions as the same trend is observed among Muslim populations in Indonesia and Malaysia. At the other end of the spectrum, Yemen (arguably the poorest country in the MENA region) unsurprisingly occupies the last position while per capita consumption rates in Algeria, Iraq, Egypt, Morocco and Libya are below 2 kg per capita, marking a substantial potential for growth in countries with large populations and growing economies. Generally speaking, the structure of MENA tissue demand is focused toward facial tissues and hankies (39%), followed by toilet paper (35%) and finally toweling and napkins (25%), though a slight increase towards toilet paper and toweling can be expected.

.jpg) |

.jpg) |

|

Figure 4: Tissue Consumption MENA Region in select Countries (2017) |

Figure 5: Per Capita Tissue Consumption (2016) |

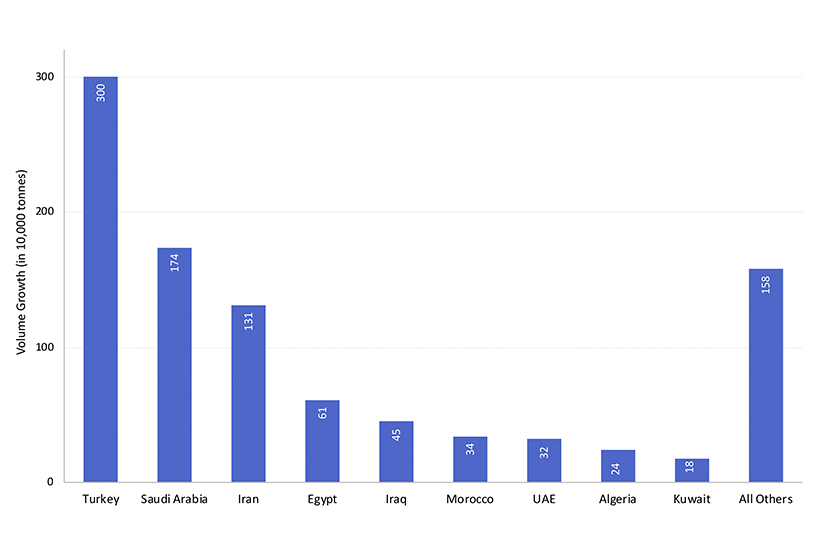

At about 8.5%, tissue expenditures in MENA has exhibited satisfactory average growth rates equivalent to about 950,000 tonnes over the 10-year period between 2006 and 2016. However, looking deeper into annual growth rates reveals inconsistent annual rates caused by both political and economic turbulences in the region. The civil war in Syria has been one of the main reasons for this instability, a matter that can be easily noticed with a stunted growth in 2012 (i.e.: a year after the civil unrest started). A short-lived demand growth was observed in 2015 reaching 11%, only to recoil in 2016 as Saudi Arabia's tissue consumption contracted as domestic production was facing challenges leading to decreased imports as a reflection of the slowed economy and lower consumer spending (Figure 6). It is speculated that 2017 have mirrored the previous year with growth rates reaching 6-7%. Meanwhile, Turkey and Iran have shown strong growth rates in recent years. Turkey is the leader in terms of volume growth in the past 10 years, followed by Saudi Arabia and Iran. In North Africa, Egypt, Morocco, and Algeria have also booked good volume growth, backed by new tissue capacities installed in recent years (Figure 7). Fortunately, the improvements in the security and political environment in Iraq has driven the tissue demand to developed positively.

.jpg) |

|

|

Figure 6: Tissue consumption growth rates in the MENA region (2006-2017) |

Figure 7: Tissue consumption volume growth in the MENA region (2006-2017) |

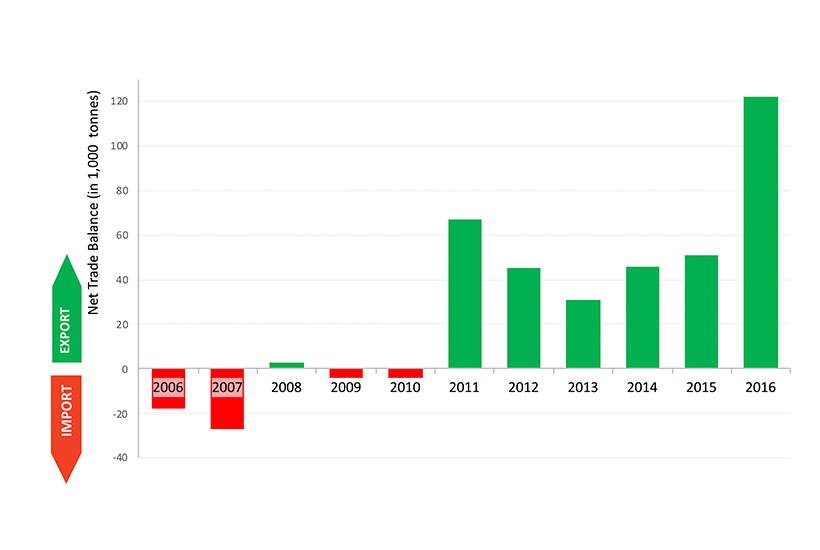

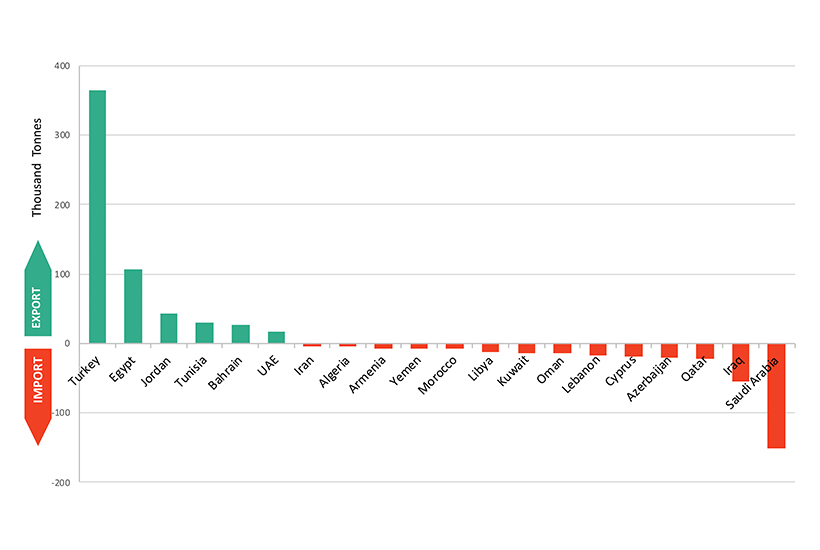

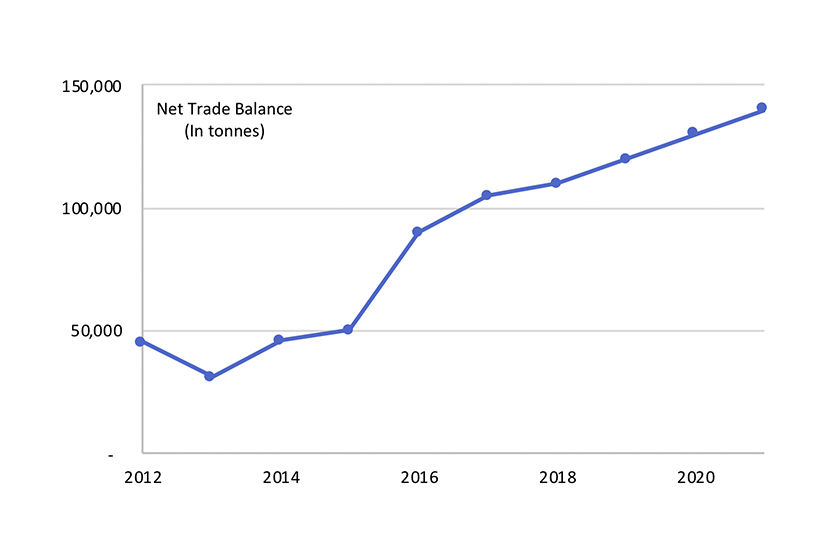

Recent investments in Turkey have impacted this dynamic sector regionally; leading to a transformation from a typically small net import market into net export in less than a decade (Figure 8). Net exports have quickly exceeded the benchmark of 100,000 tonnes by 2016. By country, Turkey is the main net exporter, and actually the fourth largest tissue net exporter worldwide, this net trade turn-around can be attributed to the addition of one single-width tissue machine per year (Figure 9). Turkey has very rapidly reinforced its position as an important tissue supplier on the global scale. In 2006, it exported about 60,000 tonnes of tissue rolls and converted products, but by 2017 the export volume had grown to 374,000 tonnes, thanks to many recent export-oriented investments in the country. The second largest net exporter in MENA is actually Egypt, followed by Jordan, Tunisia, Bahrain and the United Arab Emirates. The latter could possible soon jump to third place due to some anticipated capacity augmentations. Bearing in mind that Saudi Arabia is the main net importer, it is worth mentioning that for parent roll suppliers in UAE, Saudi Arabia is a very important target market.

|

|

|

Figure 8: Tissue net trade balance in the MENA region (2006-2016) |

Figure 9: Tissue net trade balance by country (2017) |

Future demand prospects

Overview

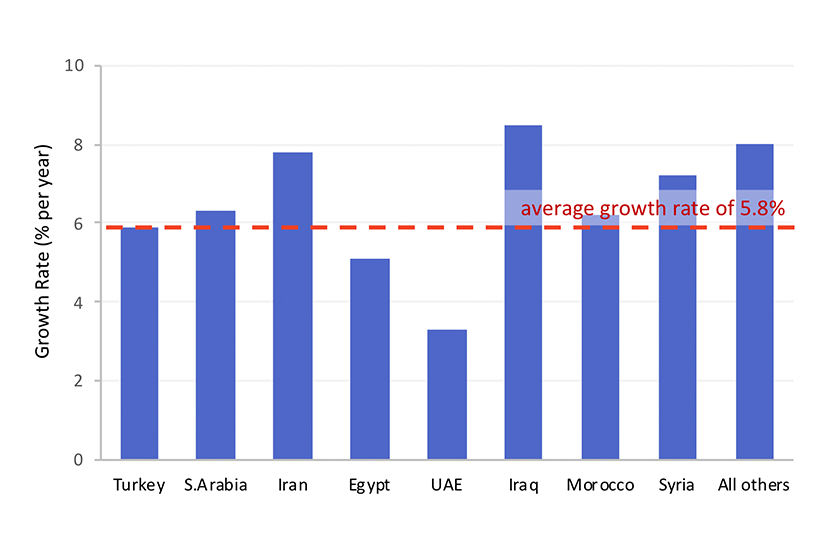

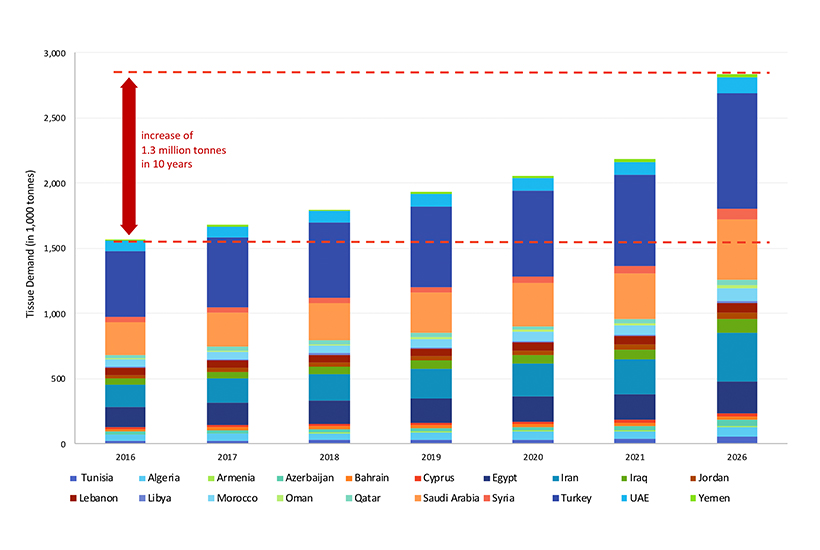

The outlook for tissue demand growth in the region is positive, provided no major new political turmoil will shake the region, and that the situation in Syria and Iraq will continue to improve, as expected based on recent political developments (Figure 10). Fact of the matter, Syria, Iraq, and Iran are expected to have the highest growth rates in the 10-year forecast period. However, the dissolution of the sanctions against Iran seems to take longer than anticipated, due to the change in the US politics. Overall, a growth rate forecast of 5.8% is anticipated for the upcoming decade; though it might seem like a humble forecast, one needs to keep in mind that several countries have already reached a high per capita tissue consumption which will reduce the average growth rate (see previous section “Recent market trends”). Total tissue consumption will grow by about 1.3 million tonnes in the coming years to reach 3.0 million tonnes in 2026 (Figure 11). Among the largest countries, both Turkey and Saudi Arabia are expected to have good further growth prospects, this is also expected in the North African countries. Lower growth rates in some countries such as UAE, Lebanon, and Kuwait due to already well-developed per capita rates of tissue consumption. A good rule of thumb to keep in mind during expansions: the MENA region can absorb two large tissue machines per year.

|

|

|

Figure 10: Expected tissue consumption growth rates in the MENA region by main country (2016-2026) |

Figure 11: Expected tissue demand growth volume in the MENA region by main country (2016-2026) |

Zooming on the Turkish market

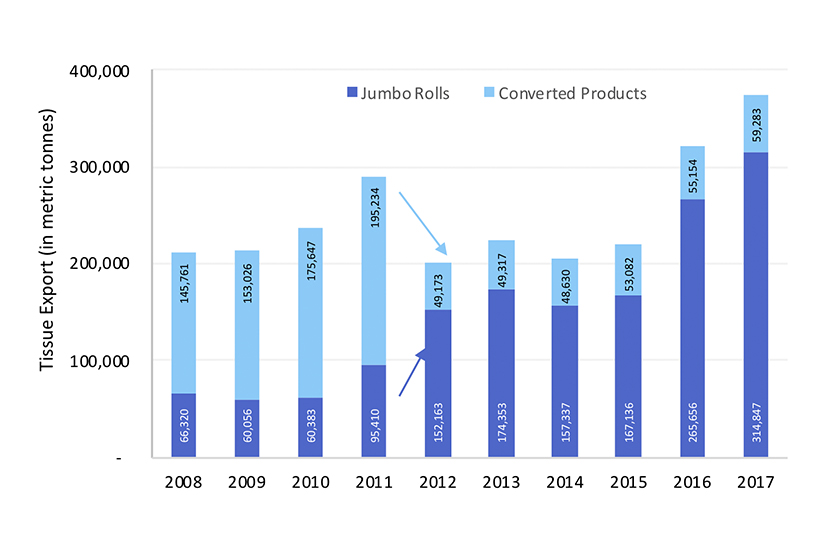

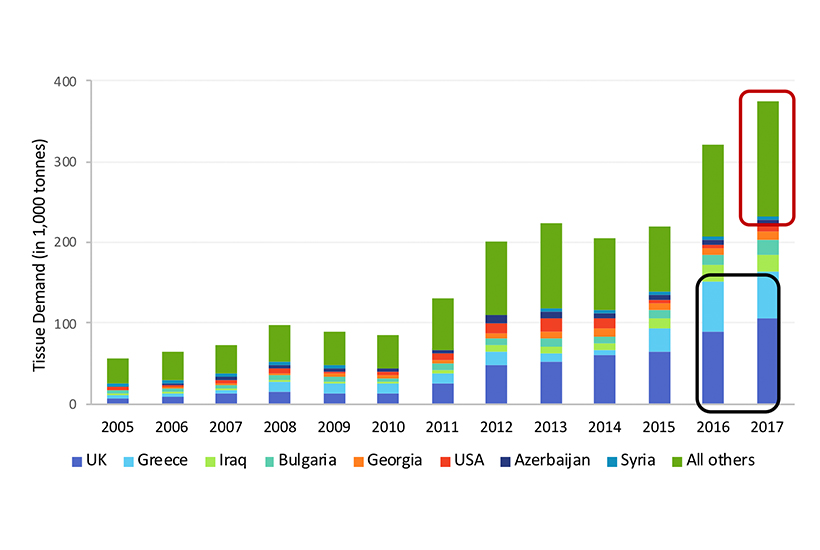

The Development of Turkish Tissue export was launched by major investments in tissue machines around 2011-2012 (spearheaded by the likes of AK Gida, Hayat Kimya, Tezol Tütün, Lila Kagit, Eka). In addition, to transforming the country’ net trade status, these new investments also lead to Turkey exporting predominantly parent rolls instead of converted products (Figure 12). This export business has been in growth mode; 2018 so far (until May) shows a similar level like 2017. The United Kingdom (UK) is its main target market today; exports to the UK account for 28% of its total exports. Though Greece and some neighboring countries are also important destinations for Turkish suppliers, and slightly surprisingly the US market as well in recent years (Figure 13).

|

|

|

Figure 12: Turkish tissue export development |

Figure 13: Turkish tissue export growth (2005-2017) |

Supply Developments

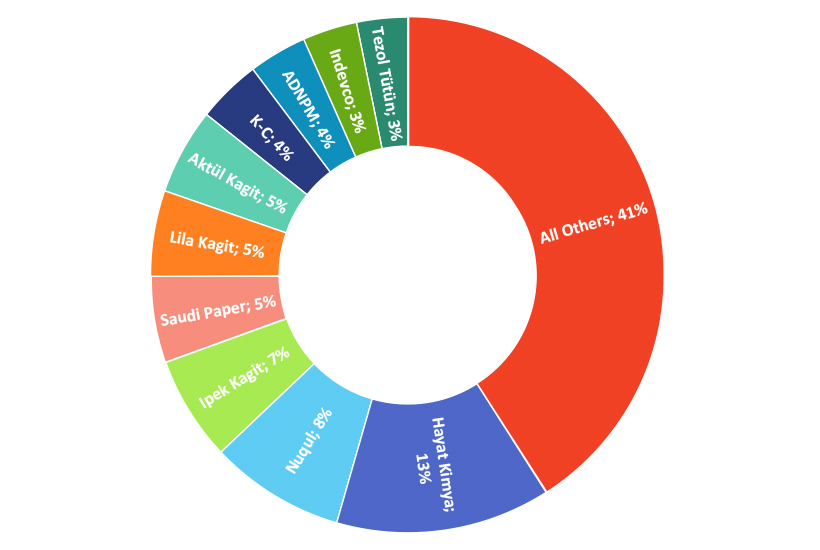

The structure of tissue supply in the MENA region is divided between minor manufacturer and industry giants. Small tissue mills and independent tissue converters play a major role in several countries, most notably in Saudi Arabia and the UAE. While the Turkish Hayat Kimya has expanded rapidly and now runs three mills in Turkey and one in Egypt, making it the largest supplier in the MENA region. The Nuqul Group has mills in Jordan, UAE, and Egypt, and is now the second largest tissue company based on tissue capacity. The top three is completed by the Turkish Eczacibasi Consumer Products, formerly known as Ipek Kagit. In spite of their apparent magnitude, these three largest suppliers only account for about 29% of total capacity, while the top five for 40%, and the top 10 companies for 60% of total tissue capacity which is estimated at 2.6 Million Tonnes (Figure 14).

|

|

|

Figure 14: Capacity shares of the main suppliers in the MENA region (December 2017) |

|

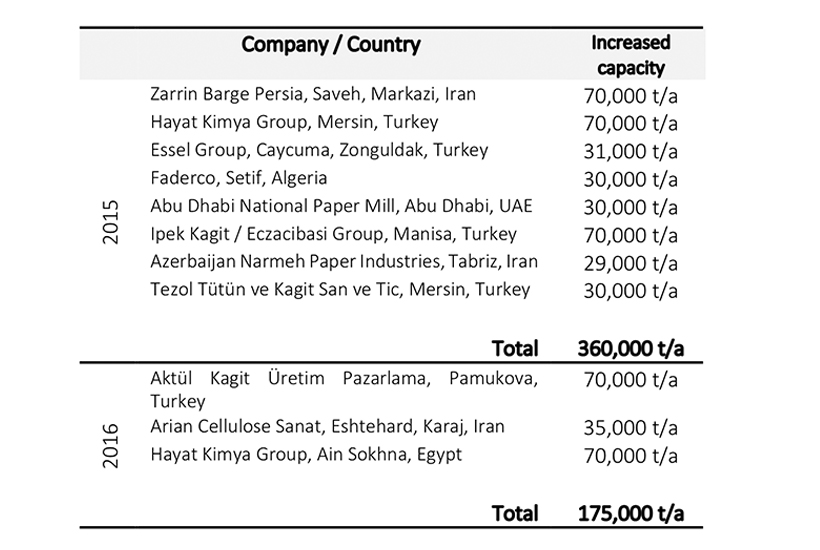

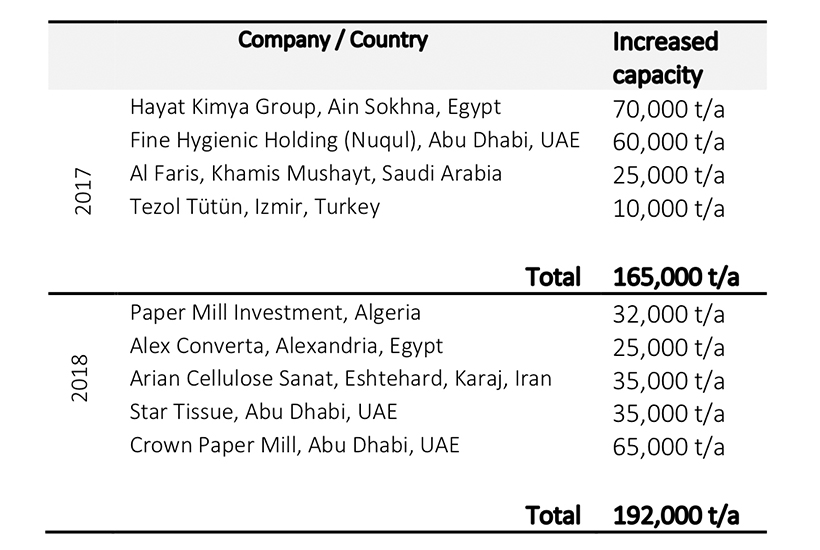

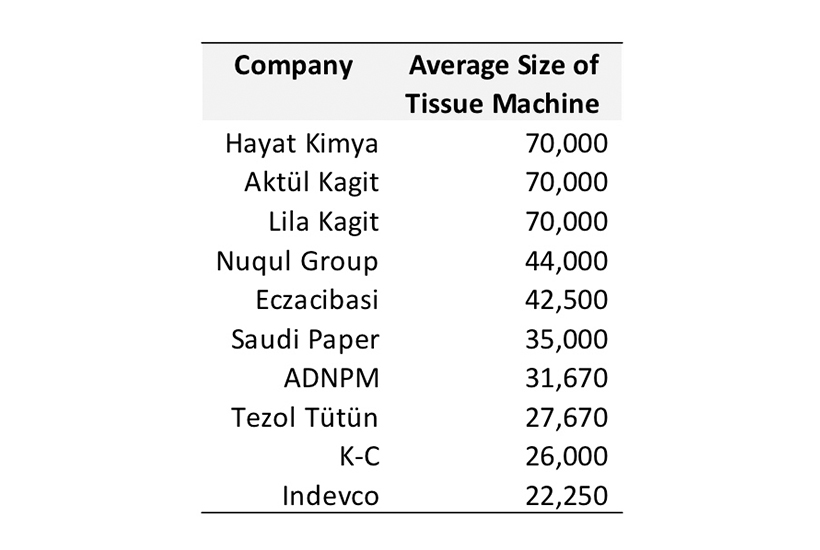

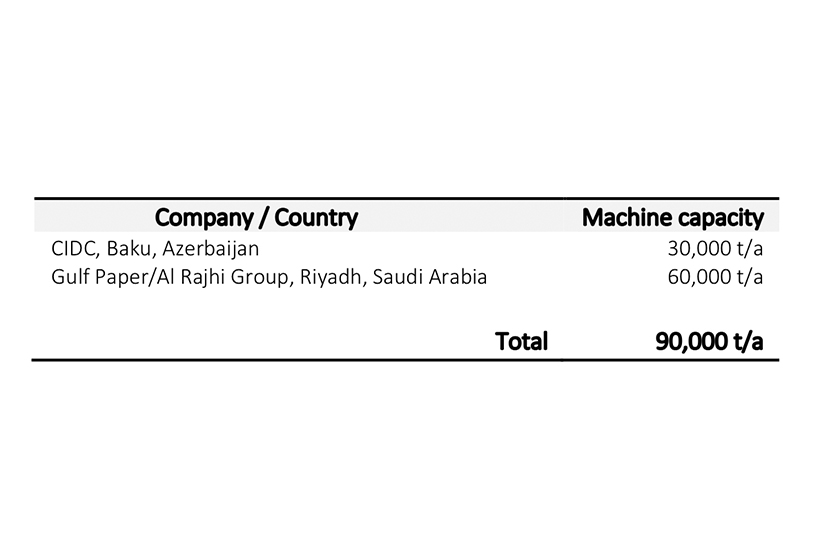

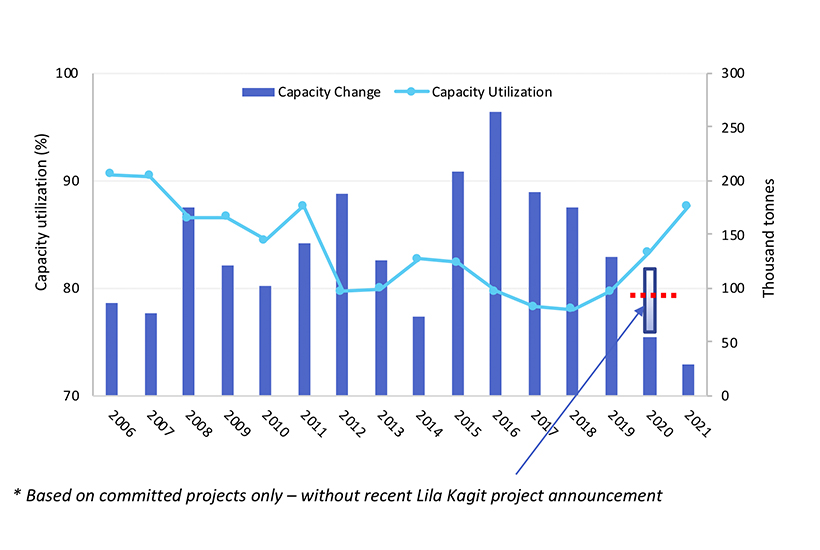

Nevertheless, the region has in fact witnessed considerable investment activities in recent years. In 2015, about 360,000 tonnes of annual tissue capacity came on stream (Table 1), accounting for more than three times the regional consumption growth, a rather substantial increase for a small market regardless of the growth in exports. The following year, investment was more reasonable with an expansion of 175,000 tonnes, though the capacity increases still exceeded the gradual market growth in the region. Noting that the market is capable of withstanding the addition of only two machine per year whereas investments are exceeding this threshold: indeed 2017 saw the addition of four new machines, two of which are of large width leading an addition of 165,000 tonnes. Further asset development in the UAE in 2018 also pushed the overall capacity increase to 192,000 tonnes, far higher than market absorption capacity as well (Table 2). A possible cause for this momentum is the competitive modern double-width tissue equipment operated by leading Turkish companies contributing to their cost-competitiveness. The average size of Turkish equipment is presented in Table 3. Be that as it may, the outlook for upcoming years appears to more subdued. Potential projects under consideration for 2019-2020 add another 90,000 tonnes, though new capacity plans will certainly emerge (Table 4).

|

|

|

Table 1: Major tissue capacity changes (2015-2016) |

Table 2: Major tissue capacity changes (2017-2018) |

|

|

|

Table 3: Average tissue machine size of main MENA suppliers |

Table 4: Prospective projects |

Outlook

New partly export-oriented investments will likely increase tissue net exports further to about 140,000 tonnes by 2021 (Figure 15). The 2015-2017 surge in investments added substantial overall capacity leading to the average capacity utilization to nosedive deeply below 80% (Figure 16). This overcapacity may eventually force the market to capacity closures or other possible alternatives might be exporting parent roll out of region.

|

|

|

Figure 15: Expected net trade balance in MENA region |

Figure 16: Net capacity change and average tissue capacity utilization |

KEY TAKEAWAYS