Pressure on water supply keeps building up; a trend that we cannot expect to regress as the planet’s population (and needs) keeps growing. In response, an immersing consciousness among consumers as well as a growing need to reduce costs among producers is driving the tissue industry to adopt more sustainable techniques in order to satisfy customer needs and save on production costs. A recent industry study by Mr. Matt Elhardt, Vice President of Business Development at Fisher International Inc., a business intelligence consulting firm, has delved into the highlights of water efficiency measures and the industry’s response to growing water scarcity concerns. The following is an overview of the aforementioned research.

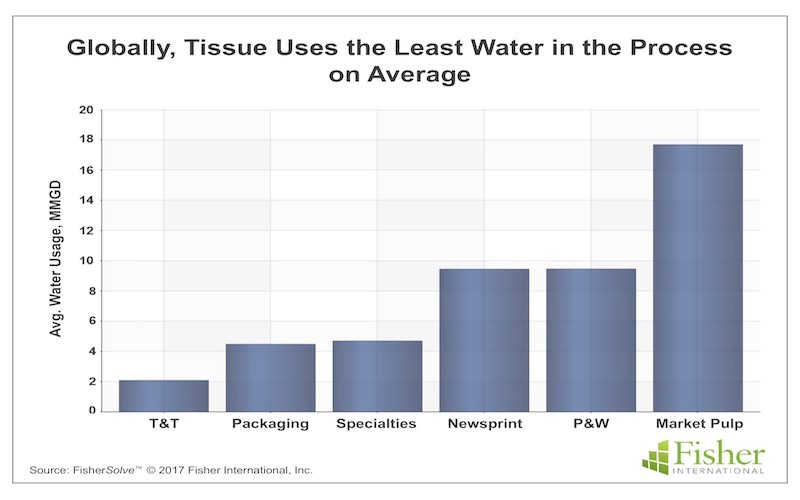

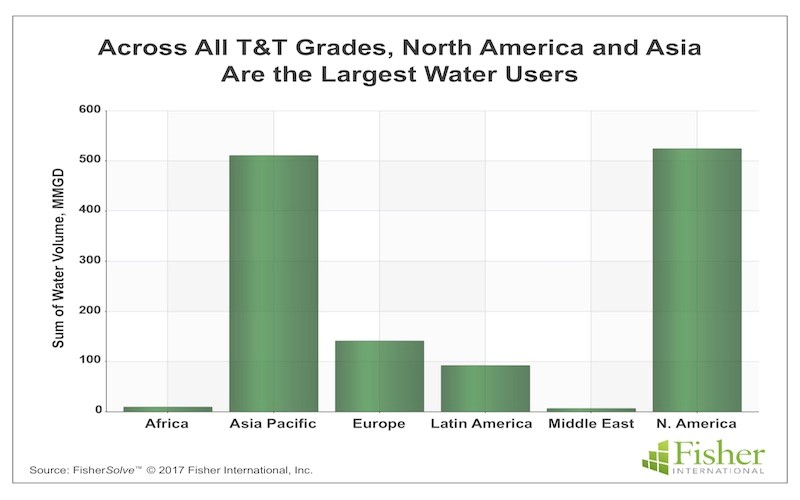

According to Mr. Elhardt’s study, the tissue industry process is not the largest consumer of water; industries such as Printing and Writing (P&W) and Newsprint in reality top the charts consuming over 9 million gallons per day (MMGD) on average, with the market pulp industry coming at a whopping average of over 17.5 MMGD (See Figure 1). Within the tissue industry, North America and Asia are found to be the largest water users across all Tissue & Towel (T&T) grades. Each region consumes in total over 500 MMGD of water, whereas Europe and Latin America trail behind them at about 150 MMGD and 90 MMGD, respectively (See Figure 2).

|

|

|

Figure 1- Water usage per industry |

Figure 2- Water usage in T&T industry per region |

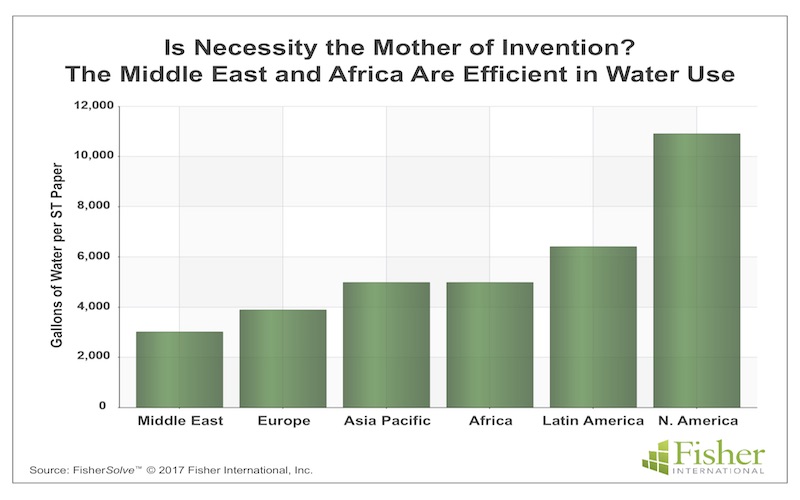

Notably, T&T industries in the Middle East and Africa are the smallest consumers of water in the world, a fact that was not lost on Mr. Elhardt, begging the question, is necessity the mother of invention? Certainly, there is a correlation between availability of water and the urgency to use water efficient production techniques and equipment. Predictably, the T&T industry in North America is the largest consumer of water in the world (See Figure 3). Truly, American virgin integrated mills use almost four and ten times the water volume than its counterparts China and Germany. Even recycled integrated mills in the U.S. use significantly more water than identical mills in Europe or China (See Figure 4).

|

|

|

Figure 3- Water usage among global regions per S T paper |

Figure 4- Average water usage among developed countries |

A similar trend is seen with German non-integratedtissuemills which use a fifth of the water used in U.S. mills (See Figure 5). This matter is independent to the age of the used equipment, as machinery in both countries is of similar age (between 23-27 years). In comparison, machinery used in non-integrated tissue mills in China is newer (average age of 3 years), operates on newer sites (average year of establishment is 2000), and still with an average rate of water consumption (per ton of paper) comparable to that of Germany (See Figure 6). The discrepancy in water efficiency is also seen among users of advanced technologies as not all machineries are created equal. The differences in water consumption among cutting-edge tissue machines is quite obvious when comparing the average water usage of machinery in North America to other parts of the world (See Figure 7); yet again the Middle East and Europe still manage to outdo North American industries in terms of water efficiency.

.jpg) |

.jpg) |

|

Figure 5- Comparison in water usage between German and US mills |

Figure 6- Comparison in water usage in terms of age of equipment |

|

|

|

Figure 7- Water consumption in new technology machines |

Figure 8- Distribution of water scarcity around the globe |

Pressure to conserve water differs by location; though as evident by the European model, the pressure may not be due to water scarcity. Europe is registered as a low water risk (See Figure 8), with some locations considered a very low risk such as Scandinavia; however, across the board, tissue mills in the continent are still some of the world’s most efficient water users. This contradiction stems from Europe’s natural inclination to be more environmentally conscious than the United States, despite the latter’s sincere intent to be environmentally friendly. Europeans live on a continent where space comes at a premium; thus they had to learn early on to live with greater awareness of human’s impact on nature. So, building huge water or wastewater treatment facilities is a luxury, and any measure (or machinery) that can lead to decreased consumption is welcomed.

On the other end of the spectrum, water scarcity is a pressing concern in other locations. A prominent example of real world impact of water scarcity is the Tamil Nadu Newsprint and Paper mill, one of largest bagasse-based paper mills in Asia. In 2017, their mills at Pugalur in Tamil Nadu had to shut down their operations due to acute water scarcity. Eventually, they did resume their normal production following renewed availability of water, the production halt meant a production loss of about 400 tonnes a day. Nevertheless, the withdrawal of 56 million liters per day need by the mill is causing added pressure on water resource in the area and leading to protests by residents of neighboring villages who are struggling to meet the drinking water requirement.

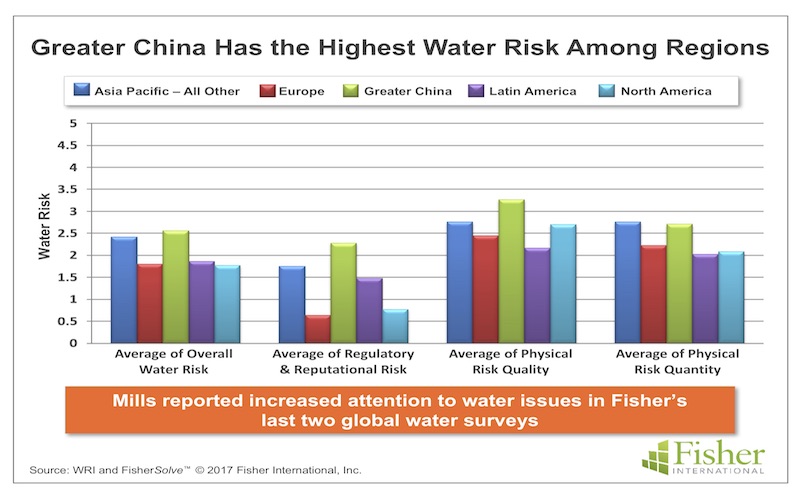

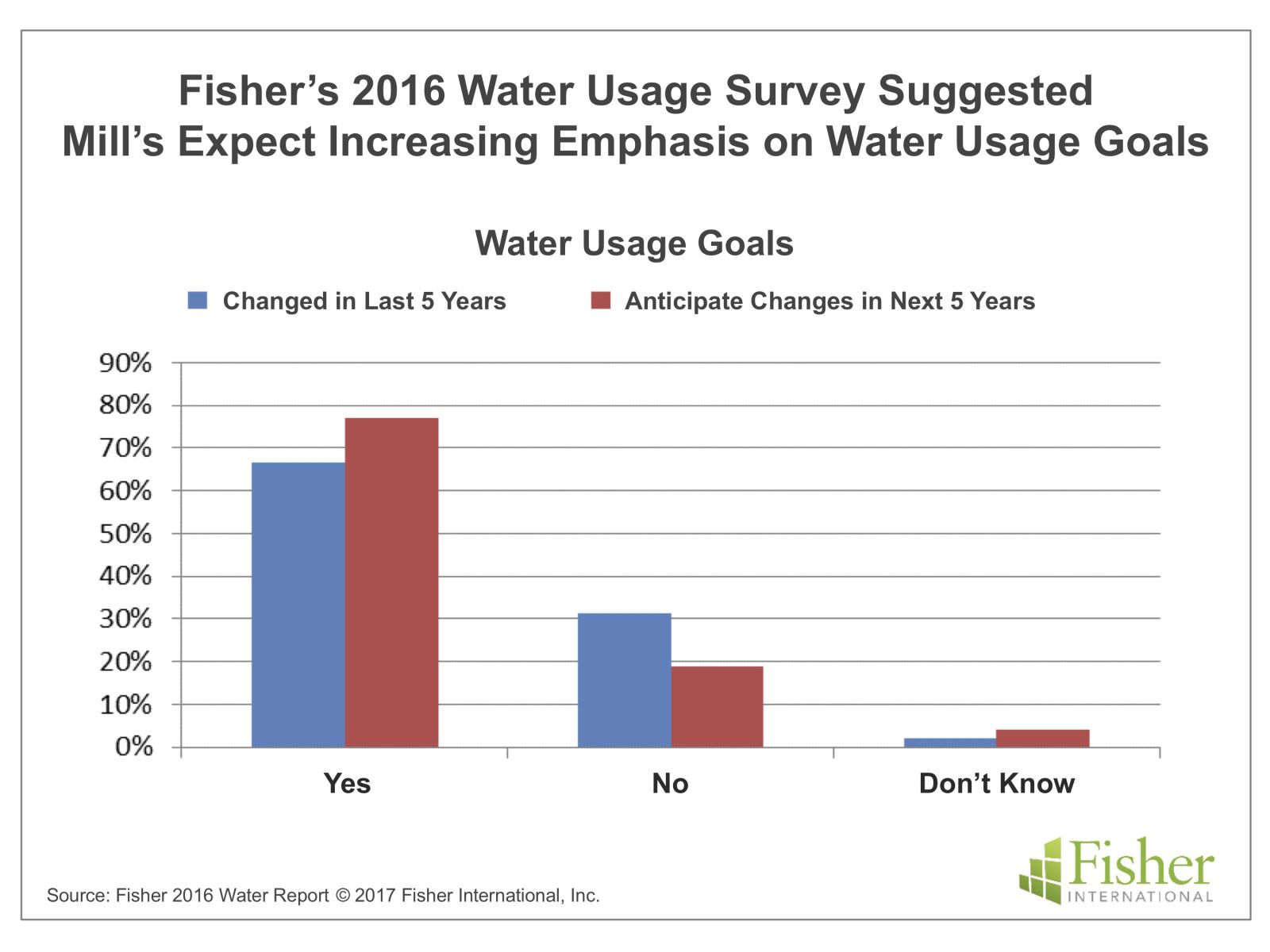

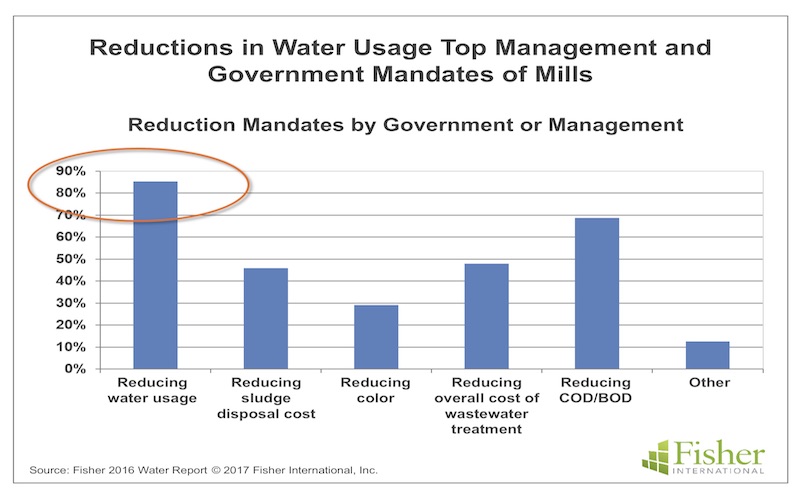

The situation in neighboring China is similar; compared to Europe, Asia pacific and both American continents, greater China has the highest water risk across all possible categories (See Figure 9). Thus it is no wonder that Fisher’s 2016 water usage survey attested that water usage goals at the mills were emphasized in the past 5 years, and will continue to be in the future (See Figure 10). This validated another survey which presented water reduction initiatives as the most pressing mandate by governments and top managements alike (See Figure 11).

|

|

|

Figure 9- Water risk among regions |

Figure 10- Results of water usage survey |

Finding the reason behind the rising interest in water conservation measures may seems like looking for the answer to the chicken or the egg question. Whether it is the increased interest in water conservation by the consumers or whether it is high risk water scarcity locations; water efficiency is a powerful marketing tool that brands are taking note of. While it is unclear whether consumers will drive efficiency, brands are focusing on absolute water reduction. Indeed, Unilever reported that 33% of consumers are now choosing to buy brands based on their social and environmental impact. An observation that other companies like Kimberly-Clark (K-C), Georgia-Pacific (GP), and Procter & Gamble (P&G) are also noticing. In fact, 2016 was K-C’s first year implementing their 2022 sustainability strategy which included goals such as reducing greenhouse gases through water and energy conservation initiatives. Likewise, GP has been tracking their gas emissions, wastewater effluent discharge, and water consumption since 2009 and publicizing the level of reductions in their annual reports. Finally, P&G set several sustainable goals for the year 2020, including Goal 1 “Reduce water used in P&G manufacturing facilities by 20% per unit of production by 2020, with a specific focus on conservation efforts at facilities located in water-stressed regions.”

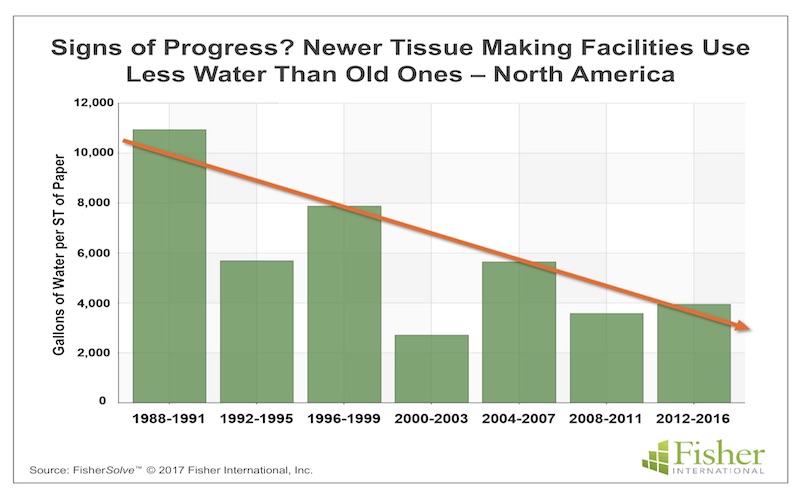

The industry has a long way to go to meet the American Forest & Paper Association (AF & PA) 2020 goal of water usage. But strides are being made to reach the 12% water reduction goal set by the association for their member’s pulp and paper mills (from 2005 to 2020), signs of progress are showing as newer North American tissue making facilities are using less water than old ones (See Figure 12). Ultimately, reducing water consumption (so long as product performance is met) will always be a good “idea” as it saves on the use of energy, chemical, and even capital investment. So whether a mill is interested in sustainable development or not, water conservation is a smart business and economic decision anyways. Still, for mills located in high risk water scarcity areas, or companies catering to markets with conscious consumers, there is long-lived value in staying ahead of the curve and going green.

|

|

|

Figure 11- Water efficiency mandates by governments or managements |

Figure 12- Water usage in the last three decades in North America |