With a population of 1.2 billion - corresponding to the number of inhabitants of China or four times the United States of America - and a gross domestic product of USD 1,800 billion equaling the size of the French Economy, one could expect that Africa could follow China and be the next growth motor for the global economy and also the nonwovens business. Latest investments into diaper production and many other Foreign Direct Investments could be first indications that the continent is eventually starting to become a more industrialized region with local production footprint to supply the countries. But is this a sustainable trend or is Africa going to remain the key source for many raw materials and a net importer of most of its consumer goods and machinery?

The sheer geographical dimension of Africa is impressing: Theoretically, the surface area of the United States of America, China, India, Japan, Spain, France, Germany, Italy and Eastern Europe could be fitted into the continent. And so is its diversity, since almost the only similarity that African countries have are to be located on the same continent. In most of the other aspects like language, religion, culture, politics, Africa is an extremely heterogeneous continent, ranging from upper-middle-income countries like South Africa and Botswana to the poorest countries where the average disposable income is below two dollars a day per capita.

Geographically, Africa can be split into two main areas: Northern Africa and Sub-Saharan Africa. The vast Sahara desert that spreads from the African Atlantic coast to the Red Sea covering a surface that almost corresponds to the size of the United States of America, is a sharp and natural barrier that always separated North Africa from the rest of Africa and made the North African region to be more driven and oriented towards Europe and the Middle East. In Sub-Sahara the regions could be further divided into South Africa, East Africa and West Africa.

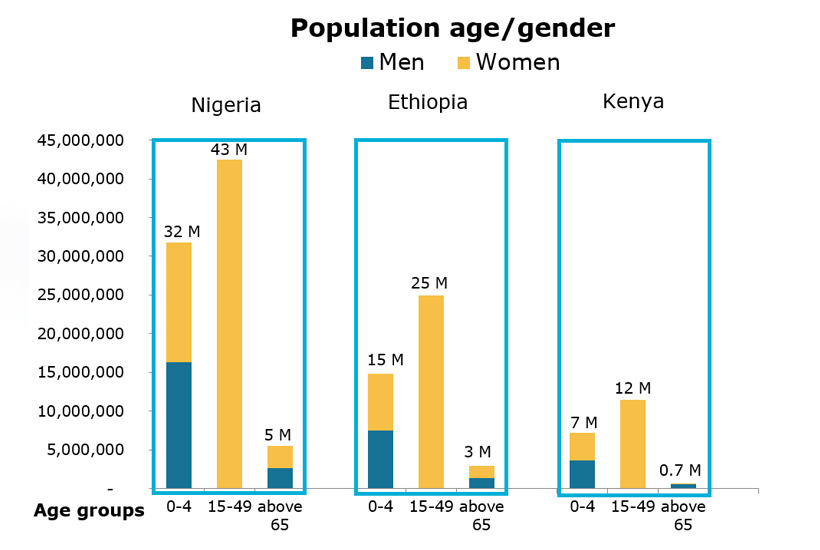

To clarify whether there is a localization of the hygiene industry in Africa and if this is a future megatrend or just a lonely beacon, Schlegel und Partner, a German consultancy specialized in nonwovens and specialty paper markets, analyzed Nigeria, Ethiopia and Kenya in the Sub-Saharan region by combining desk research findings with interviews with industry experts along the hygiene value chain in the selected countries and also in Europe, Turkey, South Africa and the Middle East. Nigeria, with over 190 million inhabitants and one of the worlds’ lowest life expectancy rates with 53 years of average (compared to China with 76 years) represents West Africa, Ethiopia with over 100 million people and a life expectancy rate of 64 years and Kenya with 67 years of life expectancy and total inhabitants of about 48 million are to represent the East African region.

Comparing these three countries with China and the world average, regarding the growth rate of the Gross Domestic Product in 2016, Ethiopia is with 7.5% leading the group, followed by China with 6.7% and Kenya with 5.8%. Nigeria experienced a shrinking economy in 2016 with a minus of 1.5% compared to the previous year. All three governments of the African states were increasing their efforts to attract investments and to build a local manufacturing footprint for many different sectors. Whereas Nigeria focused very much on automotive and agriculture, the Ethiopian government has been heavily promoting local pharmaceutical production and the establishment of industrial parks to enhance foreign investment, especially from Asia. Alongside with modernizing roads, railways and power plants and even connecting the landlocked country with the Red Sea over a railway line, this has convinced many investors to favor Ethiopia over other countries. Kenya on the other hand has a long history of periods with economic growth and setbacks alike. The country now wants to attract additional companies by granting tax rebates and offering subsidies for local producers to reduce production costs.

The purchasing power per capita in the three countries varies a lot. Whereas Nigerias’ average is at 6,000 USD, Kenya’s is at 3,400 USD and Ethiopia’s is only at 2,000 USD, but growing steadily.

It is a widely accepted approach in the hygiene and nonwovens business to access the general preparedness of a country’s population to use a sanitary napkin, baby diaper, wipes and adult incontinence products by looking at the purchasing power per capita in USD. The first nonwovens hygiene product that is usually purchasing by a female consumer when available are sanitary napkins. This normally starts at a purchasing power of 1,000 USD. Next step is seen at 3,500 USD per capita when baby diapers are considered to be bought, followed by wipes (7,000 USD per capita) and finally adult incontinence products at 10,000 USD.

For the selected countries in Sub-Sahara this should give hints for a stable market for feminine care products and baby diapers, but not for wipes and adult incontinence.

The first hygiene product sector analyzed was the situation for feminine Care products, like sanitary napkins and panty liners in Sub-Saharan Africa. The general knowledge of girls and women about the proper usage of menstrual pads, their access to the products and the necessary money to buy the products is still limited all of the selected countries. Also, menstruation is widely sees as stigma and a cultural taboo that often leads to not speaking about the products among girls, thus not buying or using the pads. The alternatives that are still widely used are leaves, sand, rags and in more developed countries washable pads. Infections, not being able to attend school and not participating in the social life are very often consequences of improper products. Therefor governments, NGOs and also hygiene companies are heavily trying to move menstruation out of the closet and are promoting the usage of feminine hygiene products through educational programs, funding and giving the products for free.

Kenya has abolished the value-added tax on feminine hygiene products and supports the distribution of sanitary pads in schools as well as is trying to educate girls on their usage. Still, out of 12 million menstruating girls and women only 20% use sanitary pads in Kenya. Girls miss about 20% of their school days simply because they do not have access to private rooms or to only very few restrooms, also because they do not use menstrual products at all or fear bullying if detected that they are menstruating. Since Kenya has a long history of foreign direct investments, many international sanitary napkin brands were available in the country and some local players have also established themselves like for example Chandaria, African Cotton and Interconsumer. Despite the existence of local players, more than 75% of the hygiene products are imported from China, Nigeria and South Africa. Schlegel und Partner does not expect a further localization of hygiene production for Kenya, since international players moved out of the countries and the supply situation from abroad is not a bottleneck. A different situation is found in Nigeria where there are only 20% of the products being imported from other countries. With an estimate of 43 million consumers between the age of 15 and 49 there is a wide selection of international and local brands that do have production facilities in the country. In Ethiopia, there is a total lack of local production of sanitary pads that are required by 25 million girls and women between 15 and 49 years of age.

In the baby diapers segment, we have a total population of more than 50 million children under the age of 4 in the selected countries with still rising numbers. High birth rates as well as decreasing child mortality in line with an increasing income pushes the market penetration also for baby diapers, which is however still way below 10% in the covered countries. A market, in which Ontex recently opened a 11,000 square meter factory to produce baby diapers, is Ethiopia. Ethiopia has the second largest population in Africa with strong economic growth rates and a stable political climate. Up until Ontex’s investment, there was no local producer of hygiene products, so the company expects that about 40% of its production to be sold locally. In Nigeria, a country with a variety of international and local diaper producers with strong investment activities from Turkey, the players with local production were able to gain market share. However, the unfavorable economic conditions affected the purchasing power of consumers. The baby diapers brand from Wemy industries, Dr. Brown and other brands in the market like Baby Hugg, Sunfree, Cuddles, Rose Tenders and Mary Diamond are all imported. About 80% of the products are manufactured locally but the unfavorable economic conditions effect the purchasing power of the consumer and power supply problems, high rentals and high electricity and labor costs also limits the possibility to expand in Nigeria.

The third sub-segment of hygiene, adult incontinence is obviously not well developed in Africa. The share of population over the age of 65 is very low and incontinence, even though a common problem even for younger persons, is a huge taboo and there are some educational programs in hospitals to raise awareness. Most persons affected use – like everywhere on the globe - common menstrual products or avoid going out, especially the elderly or woman after giving birth. Men try to cope with incontinence by using own makeshift solutions.

The final topic of the research done by Schlegel und Partner was a screening of the localization opportunities for nonwovens producers in the region with a focus on hygiene applications. So far, there is no local production of spunbond or carded disposable nonwovens for baby diapers, femcare and adult incontinence products. All backsheets, topsheets, ADLs and hook and loop material are imported from South America, North Africa (Egypt), Asia (mainly China) and South Africa. The high production costs and the economic and political instability are the main reasons for the lacking local production.

Interest coming from nonwoven producers is building up as more investment in local hygiene production starts. The first high quality nonwoven production line in Sub-Saharan Africa was constructed by Spunchem in South Africa in 2016. In 2017, Pegas Nonwovens announced its plan to construct a new production plant in South Africa to serve the hygiene industry. Pegas would be the first international company to invest in high quality nonwovens production for hygiene in Sub-Saharan Africa.

So what is the overall bottom line in favor of a localization of the hygiene industry. To fight poverty and to develop a country in a sustainable way, it is inevitable to create jobs through establishing industries, retail and services. This has been a very successful approach for many countries in Asia. For some of the countries it is also necessary to reduce the dependency of their economies from raw material prices by diversification of new industries. The massive investments via loans from China are also boosting the localization trend and move China in the pole position for becoming the leading power in Africa. Huge numbers of Chinese workers and managers have moved to Eastern Africa to build infrastructure to improve logistics. These efforts have driven and developed certain areas in Africa much faster than any foreign development has ever done. Retail structure is developing slowly but steadily and with further increase of population including further formation of middle class and women with access to own income and educational programs, increasing usage of hygiene products is very likely.

But there are also still many obstacles to overcome. It is very hard to find and keep skilled personnel and there are frequent shortages in energy supply alongside with lack of infrastructure resulting in a lack of effective distribution system.

Another factor against localization of the hygiene sector can be found in the trend that imported products are often perceived to be more attractive than local products. This corresponds very much to the situation in China, where baby diapers that are imported from Japan are more successful than the local product even if produced by the same brand.

The long history of failure and the lack of the required base materials as well as the taboo and habits still major issues to be overcome in femcare.

And finally, since there is not enough localization going on in most of the countries we do not expect enough demand for a good capacity exploitation for major hygiene nonwovens players. We do see major investments in general done by Chinese companies, so it is very likely that Africa will become the new “China” for the Chinese with Ethiopia and Kenya in the lead position. Due to modern communication techniques and the globalization of media, the general conditions to change consumption behavior have never been better for Africa. A change in mindset of the potential investors coming from Europe and the USA is advisable otherwise the region will be developed by Asian players and not the Europeans.

Schlegel und Partner GmbH is a boutique consultancy, founded in 1992 with extensive international industry experience. Today, responsibility for the continuing success of the business lies with five partners, together with a well-coordinated international team of 40 consultants. All levels of the industrial value chain are examined with a clear focus on technical markets. Together with the clients coming exclusively from a B2B environment, Schlegel and Partners develops innovative concepts and monitors their implementation. Ms. Silke Brand-Kirsch is founding member of Schlegel and Partners in Germany. Today, she is focusing her work as executive partner on nonwovens, chemicals and the corresponding industry sectors.

Silke Brand-Kirsch

Executive Partner, Schlegel und Partner